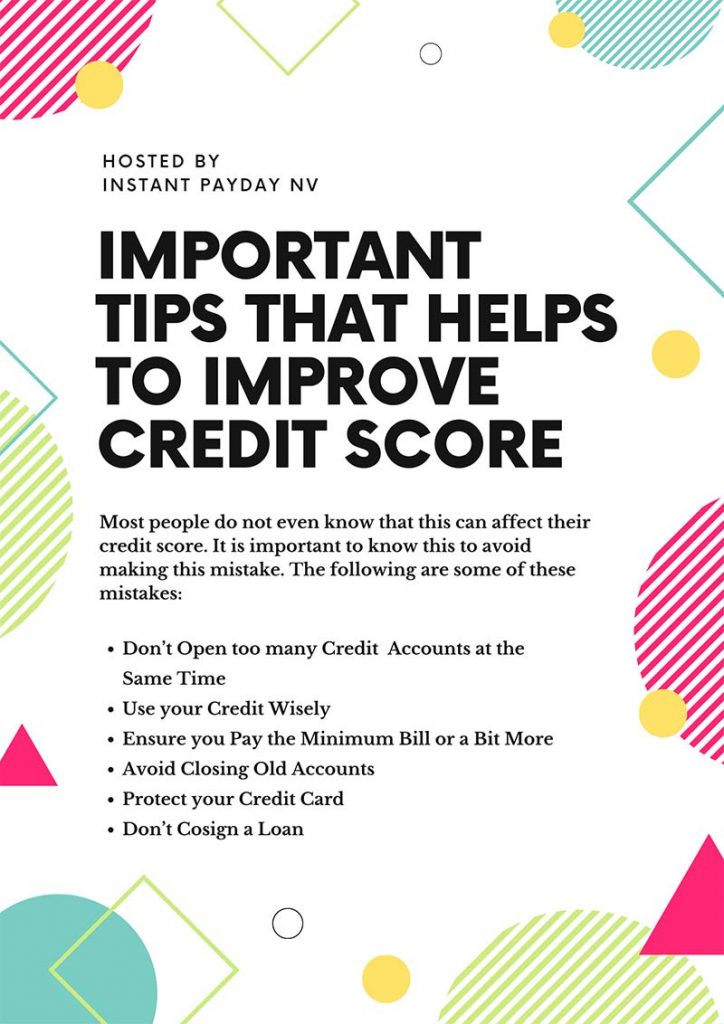

Your credit score is very important and it can affect your financial future. You need to have a good credit score to be able to get loans or get a new credit card in the future. If your credit score becomes poor, then you will be considered a credit risk and this will hurt you in the future. Whether you want an auto loan or want a business loan, a poor credit score can be disastrous. Unfortunately, there are many common mistakes people do that end up wiping out their credit score. Most people do not even know that this can affect their credit score. It is important to know this to avoid making this mistake. The following are some of these mistakes:

1) Don’t Cosign a Loan

A big mistake people make is cosigning a loan taken by someone else. This makes you responsible for the loan and if the person for whom you cosigned the loan defaults, then your credit score will be severely affected. This is a huge mistake and you should never cosign someone else’s loan.

2) Protect your Credit Card

Credit card fraud is common. While earlier thieves would physically steal your credit card, today cyber thieves can steal your credit card details and use them online. You may end with a dispute on the transactions done by the thieves. This can affect your credit score.

Download Branding Resources Guide

Building a brand starts by having the right tools and advice. Download our top 10 essential tools and resources to kick-start your branding.

3) Avoid Closing Old Accounts

A credit score is calculated using the history of all your credit accounts. Closing an account reduces your credit limit and leads to an increase in credit utilization. This can hurt your credit score and you won’t even know about it. Even if you don’t use a credit card don’t close the account to protect your credit score.

4) Ensure you Pay the Minimum or a Bit More

You need to pay the minimum amount due without fail. Not paying it leads to a levy of interest and penalty. It also negatively affects your credit history. It puts more pressure on you in the coming months and you may end up with big defaults that could wipe out your credit score. Try to pay off all your bills within the allowed credit period. If you can’t pay it all, pay the minimum or a little bit more. Also, note that defaulting on a utility bill payment can hurt your credit score, so make sure you don’t miss paying your bills.

5) Use your Credit Wisely

A thumb rule is to use only 30% of your available credit. If you overuse your credit, it affects your credit score since credit utilization is one of the factors that decides your credit score. So use your credit wisely.

6) Don’t Open too many Credit Accounts at the Same Time

Opening too many credit accounts at the same time will ensure multiple hard credit checks. This affects your credit score. When you apply for too many credit cards, it creates a perception that you are desperate for money and deep in debt. Avoid making this mistake, which could hurt your credit score.

Knowing about the above mistakes will help you avoid them so you can protect your credit score In case you do have poor credit and want a loan, then don’t worry you can opt for no credit check payday loans Las Vegas to meet your requirements. Online payday loans Nevada are a convenient way of getting a short-term loan quickly.

This type of loan is offered to people who have a job with a fixed income. The concept is that the loan would be repaid next month on payday. Since the loan is given on the basis of employment and salary, a credit check is usually not done. Applying through an online portal will be helpful as applicants can compare terms offered by different lenders and get a payday loan at the best possible terms.